By Clearday Research Team

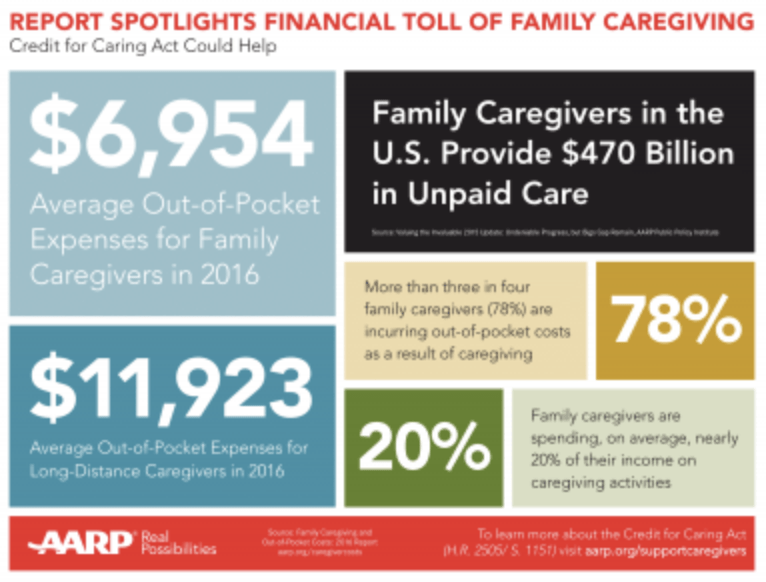

It is commonly known in the long-term care system that family caregivers are routinely unrecognized for how much they do to provide diligent service for those suffering from Alzheimer’s. Family caregivers are oftentimes strained with not only the mental and emotional burdens that are inevitably attached to the job, but the major financial concerns that can feel insufferable.

These hardships are why the Credit for Caring Act bill that recently passed in Congress feels like a great victory for the nearly 48 million family caregivers in this position. For these individuals, they can finally shift their primary focus on caring for their loved ones and be less burdened by financial stress.

According to AARP, the bill’s new, nonrefundable federal tax credit would give eligible, working family caregivers a 30 percent credit for qualified expenses they paid or incurred above $2,000 in a taxable year. The credit could help offset the costs of services like home care aides, adult day care and respite care, as well as home modifications like ramps and smart-home technology that make caregiving at home safer and easier. This bill will be a massive relief for family caregivers and could even make professional, in-home care much more accessible.

Here at Clearday™, we understand the financial and emotional toll caring for those suffering from cognitive decline can have. That’s why our mission is simple: to continue to listen and provide solutions. See how Clearday™ helps here.

This blog and related materials prepared by Clearday, Inc. may use publicly available information including market research, studies or reports by unaffiliated third parties that include market demographics and other relevant market or research information. Such information or a link to such information is available upon request. We do not warrant any such information and do not have information that causes us to believe that any such market research, studies or reports are not correct in all material respects.